Get the free mo 941x form

Show details

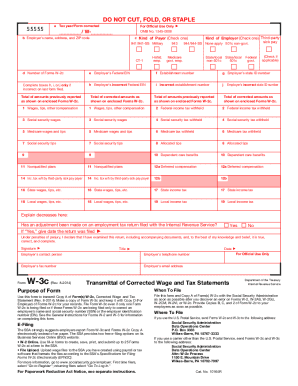

Reset Form 1. Withholding This Period. . . . . . . . 2. Compensation Deduction. . . . . . . . . 3. Previous Overpay/ Payments. . . . . . . . . 4. Balance. . . . . . . . . . ADDRESS Print Form MISSOURI

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your mo 941x form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mo 941x form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mo 941x online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mo 941x. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

How to fill out mo 941x form

How to fill out mo 941x:

01

Obtain a copy of Form 941X from the Internal Revenue Service (IRS) website or a local IRS office.

02

Review the instructions and gather the necessary information, such as the original Form 941 filing, corrections that need to be made, and any supporting documentation.

03

Enter the corrected information in the appropriate fields on Form 941X, making sure to accurately report the changes.

04

Complete the "Explanation of Changes" section on Form 941X to provide a clear explanation of why the corrections are being made.

05

Calculate the difference in tax liability or refund resulting from the corrections and enter the amounts in the appropriate fields.

06

Verify that all entries and calculations are accurate, and double-check for any errors or omissions.

07

Attach any required supporting documentation, such as amended wage reports or payroll tax records.

08

Sign and date the form, and make a copy for your records before mailing it to the appropriate IRS address as outlined in the instructions.

Who needs mo 941x:

01

Employers who have already submitted Form 941 but need to make corrections to the previously reported tax information.

02

Businesses that have overreported or underreported wages, withheld taxes, or overpaid/underpaid their payroll taxes.

03

Employers who have identified errors or discrepancies in their previous Form 941 filing and require an amendment to rectify the mistakes.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is mo 941x?

Form 941-X is an amended version of Form 941, which is the Employer's Quarterly Federal Tax Return. Form 941 is used by employers to report wages paid and taxes withheld from their employees to the Internal Revenue Service (IRS) on a quarterly basis.

Form 941-X is used to correct any errors or make changes to previously filed Form 941. It allows employers to correct information such as wages, taxes, and other deductions that were incorrectly reported or originally omitted. The form is typically used when an employer discovers a mistake on their original Form 941 and needs to correct it.

Who is required to file mo 941x?

Form 941-X should be filed by employers who need to correct errors on previously filed Form 941, Employer's Quarterly Federal Tax Return. This form is used to correct any incorrect information such as wages, taxes, or adjustments that were originally reported on Form 941.

How to fill out mo 941x?

To fill out the MO 941X form, follow these steps:

1. Begin by providing your business information at the top of the form, including your business name, address, and employer identification number (EIN).

2. Indicate the quarter and year that you are amending by entering the corresponding dates in the "Period Covered by this Return" section.

3. In Part 1 of the form, you will need to complete the "Original Return" section. Fill out the original amounts reported on Form MO 941 for the specific quarter you are amending. This includes total wages, total withholding, and total tax liability as indicated on the original return.

4. In Part 2, you will be required to report the "Changes to Tax Liability and Wages." Provide the corrected figures for wages, withholding, and tax liability for the quarter you are amending. Indicate the differences between the original return and the amended amounts in the appropriate columns.

5. Part 3 of the form is where you explain the reasons for the amendment. Provide a clear and detailed explanation for each change made, including any supporting documentation or reference to additional attached forms if necessary.

6. Next, calculate the total change in tax liability by subtracting the original amounts from the amended amounts and entering the difference in the "Total Change in Tax Liability" section.

7. If you owe additional tax as a result of the amendment, indicate the payment amount in the "Payment with Return" section. Alternatively, if your amendment results in a refund, enter the amount in the "Refund" section.

8. Finally, sign and date the form, and include your title and contact information at the bottom.

It is important to review the completed form prior to submission for accuracy and completeness. Consider consulting with a tax professional or the Missouri Department of Revenue for further assistance if needed.

What is the purpose of mo 941x?

Form 941-X is used to make corrections to previously filed Form 941, which is the Employer's Quarterly Federal Tax Return. The purpose of Form 941-X is to correct any errors or omissions in the original Form 941, such as incorrect information related to wages, tax withholdings, and employment taxes. It is necessary to file Form 941-X to ensure accurate reporting and payment of federal employment taxes.

What information must be reported on mo 941x?

Form 941-X, Adjusted Employer's Quarterly Federal Tax Return or Claim for Refund, is used to correct errors or make adjustments to previously filed Form 941, Employer's Quarterly Federal Tax Return. When filing Form 941-X, the following information must be reported:

1. Employer information: Provide your employer identification number (EIN), legal name, trade name (if any), address, and contact information.

2. Tax year and quarter: Indicate the tax year and calendar quarter being corrected.

3. Box 1: Report the corrected amount of wages, tips, and other compensation subject to federal income tax withholding.

4. Box 2: Report the corrected amount of federal income tax withheld from employees' wages.

5. Box 3: Report the corrected amount of Social Security wages subject to the 6.2% Social Security tax.

6. Box 4: Report the corrected amount of Social Security tax withheld from employees' wages.

7. Box 5: Report the corrected amount of Medicare wages and tips subject to the 1.45% Medicare tax.

8. Box 6: Report the corrected amount of Medicare tax withheld from employees' wages.

9. Box 7: Report the corrected amount of Social Security tips for the quarter, if any.

10. Box 8: Report the corrected amount of allocated tips for the quarter, if any.

11. Box 9: Report the total number of employees for the quarter.

12. Box 10: If you are correcting your tax liability, report the corrected amount of the total tax due for the quarter. If you are requesting a refund, report the corrected amount of overpaid tax.

13. Box 11: Provide an explanation for the changes being made on the form.

14. Signature and date: Sign and date the form to certify its accuracy.

It is important to review the instructions provided with Form 941-X for any additional information or requirements specific to your situation. Additionally, consult with a tax professional or the Internal Revenue Service (IRS) for guidance if needed.

When is the deadline to file mo 941x in 2023?

The deadline to file the MO-941X form in 2023 may vary depending on the specific circumstances and requirements. It is recommended to consult the Missouri Department of Revenue or a qualified tax professional to obtain the accurate and up-to-date deadline information for filing MO-941X in 2023.

What is the penalty for the late filing of mo 941x?

The penalty for the late filing of Form 941-X, which is used to correct errors on previously filed Form 941, is based on the number of days the return is late. As of 2021, the penalty is as follows:

- For returns filed 1-5 days late: $50 per return

- For returns filed 6-30 days late: $270 per return

- For returns filed more than 30 days late or not filed at all: The penalty increases to the greater of $550 per return or 2% of the balance due

It's worth noting that if the late filing was due to reasonable cause and not willful neglect, you may be able to request a penalty waiver from the IRS.

How can I modify mo 941x without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your mo 941x into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I complete mo 941x online?

Completing and signing mo 941x online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I edit mo 941x on an Android device?

You can edit, sign, and distribute mo 941x on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your mo 941x form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.